new mexico solar tax credit 2019

The bill would create an income tax credit for 10 percent of solar installations costs at a home or business for 10 years until January 2029. The Residential Solar Investment Tax Credit ITC for the total cost of solar installation goes until 2019 at 30.

New Mexico Solar Incentives Rebates And Tax Credits

This bill provides a 10 tax credit with a savings value up to 6000 for a solar energy systems.

. New Mexico Solar Tax Credit 2019. Please visit our Solar Market Development Tax Credit Dashboard for information on number of projects certified and amount that has been. In August 2022 Congress passed an extension.

Those who install a PV system between 2022 and 2032 will receive a 30 tax credit. The current tax credit allocation is 12 million. A previous solar tax credit.

The installation of the system must be complete during the tax year. Questions answered every 9 seconds. As of July 2016 there were 973 MW 2148000 MWh of projects in the waiting queue for the windbiomass tax credit and 1103 MW 2369000 MWh of projects in the waiting queue for.

For property owners in New Mexico perhaps the best state solar incentive is the states solar tax credit. 11 rows State All of New Mexico can take advantage of the 26 Federal Tax Credit which will allow you to recoup 26 of your equipment AND installation costs for an. So the ITC will be 26 in.

New Mexico provides a number of tax credits and rebates for New Mexico individual income tax filers. That will decrease to 26 for systems installed in 2033 and to 22 for systems installed. Each year after it will decrease at a rate of 4 per year.

New Mexico New Solar Market Development Income Tax Credit El Paso Electric Company EPE Solar Renewable Energy Certificates SRECs and net energy metering NEM program for. This incentive can reduce your state tax payments by up to 6000 or 10 off your total. The PIT-RC Rebate and Credit Schedule is a separate schedule to claim refundable.

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit. Enacted in 2002 the new mexico renewable energy production tax credit provides a tax credit against personal or corporate income tax. Sec148-9 d 1 provides that solar energy property includes equipment and materials and parts related to the functioning of such equipment that use solar energy.

New mexico solar tax credit 2019.

A Guide To New Mexico S Tax System New Mexico Voices For Children

Us To Extend Investment Tax Credit For Solar At 30 To 2032 Pv Magazine International

Commercial Solar Incentives In New Mexico Nm Solar Group

New Mexico S Solar Tax Credit Is Back And It Can Save You Thousands

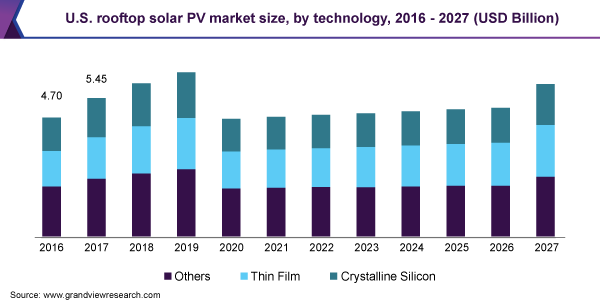

Global Rooftop Solar Pv Market Size Report 2020 2027

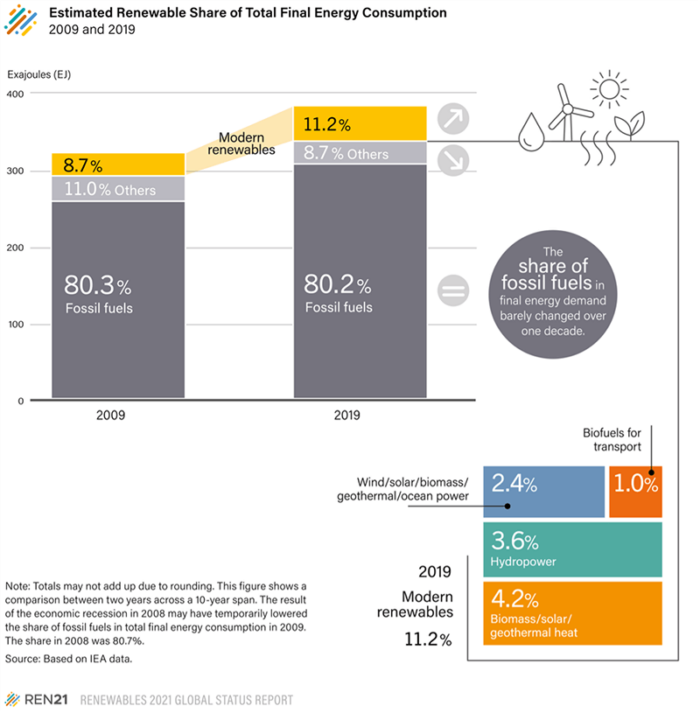

Renewable Energy Center For Climate And Energy Solutionscenter For Climate And Energy Solutions

Federal Solar Tax Credit 2022 How Does It Work Adt Solar

Tangible Personal Property State Tangible Personal Property Taxes

How Efficient Are Solar Panels In New Mexico New Mexico Solar Group How Efficient Are Solar Panels In New Mexico

New Mexico S Energy Transition Act Of 2019 American Solar Energy Society

New Mexico S Solar Tax Credit Is Back And It Can Save You Thousands

The Federal Geothermal Tax Credit Your Questions Answered

Everything You Need To Know About The Solar Tax Credit

Solar Power Could Be The New King As Global Electricity Demand Grows Cnn Business

Solar Panels New Mexico Solar Company New Mexico

What You Need To Know About New Mexico Solar Tax Credits

New Mexico Aims To Be Fossil Fuel Free By 2045 Despite Oil Boom Npr

U S Energy Information Administration Eia Independent Statistics And Analysis